The primary goal of any business is profit. One common path to higher profit is assortment expansion. Yet a wider range also complicates control.

With one SKU you manage one volume and one price. With 1,000 SKUs you must track 1,000 volumes and 1,000 prices. That explosion of variables triggers countless questions:

- Which products should the sales team emphasize?

- Which items deserve promotion and which require a price increase?

- What is the right inventory level for each SKU?

Managing such complexity becomes onerous.

A mid-market company approached Fincontrollex with 900 SKUs and mounting difficulty navigating its broad catalogue.

Problem – control issues caused by an oversized assortment.

Solution – segment SKUs by revenue and margin percentage, then act by segment.

Result – assortment reduced by 34 %, margin income up 35 %.

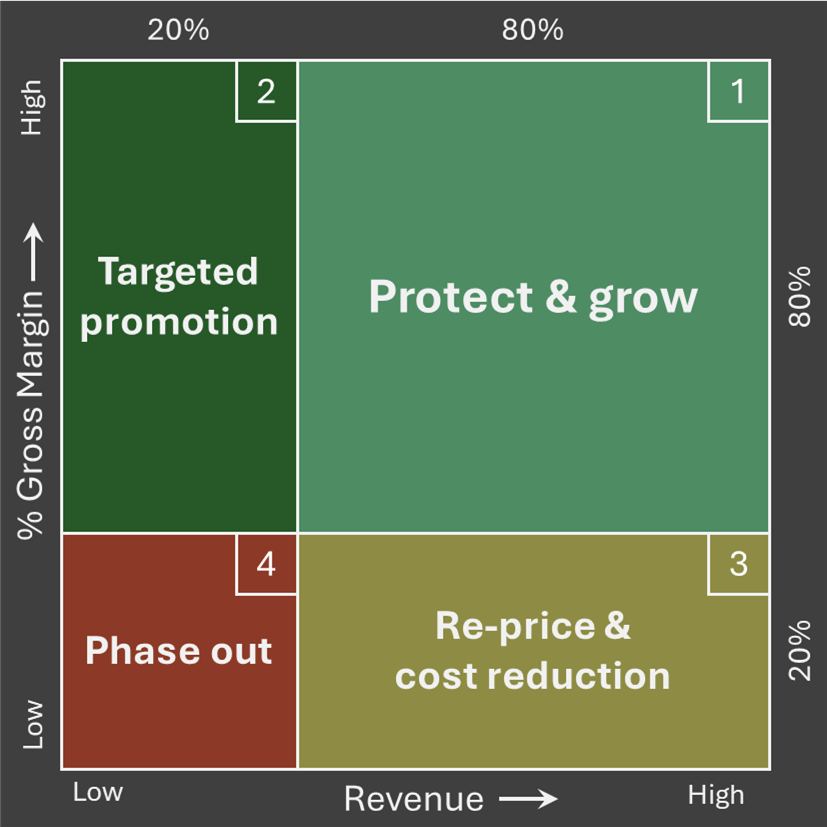

After an initial assessment, the team chose to segment the assortment. They conducted a multidimensional ABC analysis, ranking each SKU by revenue and gross-margin contribution. The resulting AA and BB categories were still too broad, so the team divided them further using the margin-to-revenue ratio. Every SKU was then assigned to one of four actionable segments, each with tailored recommendations (see Figure 1; segment numbers correspond to the quadrants). Figure 1. Segments with Recommendations

Figure 1. Segments with Recommendations

Actions executed:

- Assortment review – 313 low-value SKUs in Segment 4 were discontinued.

- Sales targets – Separate objectives set for products in Segments 1 and 2.

- Promotion calendar – Trade promotions scheduled for Segment 2 items.

- Cost reduction – Supplier renegotiation and alternative sourcing for Segment 3.

- Strategic pricing – Competitive price benchmarking and increases for Segment 3.

- Governance – Quarterly assortment review with action adjustments.

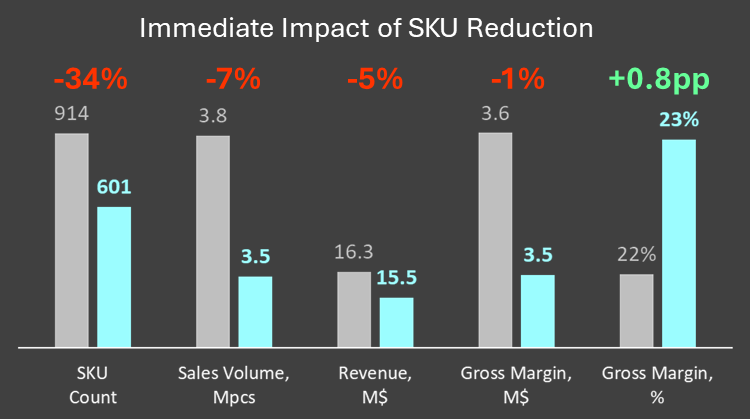

These measures create long-term value, although a modest short-term profit dip is typical. That pattern appeared immediately after the assortment rationalization (see Figure 2): the SKU count fell by 34 percent, revenue by 5 percent, and gross-margin income by just 1 percent. Put differently, management complexity dropped by a factor of 1.5 while margin loss was limited to 1 percent. The shortfall was fully offset by savings in labor costs and warehouse rent. Figure 2. Impact Right After SKU Rationalisation

Figure 2. Impact Right After SKU Rationalisation

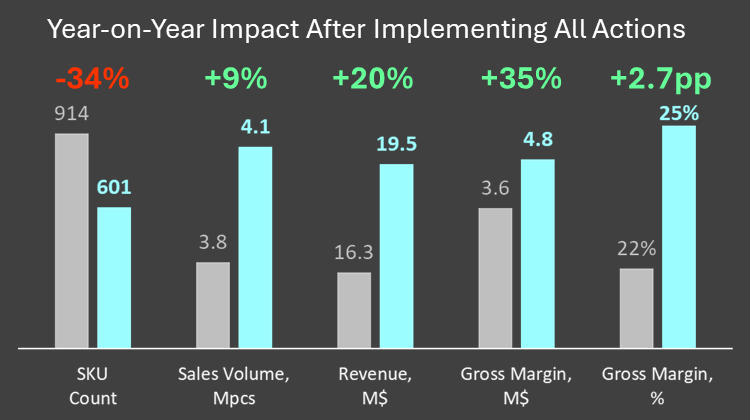

Twelve months after all measures were fully implemented, the company recorded a 20 percent increase in revenue and a 35 percent rise in margin income (see Figure 3). Figure 3. Performance One Year After Full Implementation; new product launches excluded for comparability

Figure 3. Performance One Year After Full Implementation; new product launches excluded for comparability

If you aim for comparable gains, you have two routes: Conduct the same multidimensional ABC review with your own analytics team, or request a free consultation (https://www.fincontrollex.com/consultation) as first step to deliver the outcome with far less internal effort.